In the current rapidly changing business environment, picking the right payment processor for your POS system is crucial for facilitating smooth transactions and ensuring customer satisfaction. As many businesses transition from traditional cash registers to modern cloud-based solutions, the value of integrating a reliable payment processing solution has become increasingly vital. A carefully selected payment processor not only improves the efficiency of your operations but also delivers security and flexibility that fulfill the needs of your specific industry.

Understanding what a POS system is and how it can transform your business is the initial step in making an informed decision. From improving customer experience in hospitality to offering robust inventory management features, a modern POS system is loaded with countless functionalities that can propel growth and improve productivity. As best pos system for restaurant explore your options, think about how the latest technology trends, such as touchless payments and AI integration, will play a key role in molding the future of transactions for your business.

Understanding Point of Sale Solutions

A POS solution is a blend of physical components and software that enables businesses to handle transactions and handle sales data. Historically associated with have a peek at this web-site , modern POS systems have advanced significantly and can serve a range of industries, including restaurants, hotels, and online retail. These systems not only process the actual payment process but also track inventory, produce sales reports, and boost customer engagement, making them crucial tools for modern businesses.

The innovation behind Point of Sale systems has progressed from simple cash registers to sophisticated cloud-based solutions that provide increased adaptability and flexibility. Cloud computing enables businesses to retrieve their data from any place, providing up-to-the-minute insights into sales performance and inventory levels. This transformation allows minor businesses to utilize the similar advanced features that were once reserved to larger corporations, balancing the playing field in fierce markets.

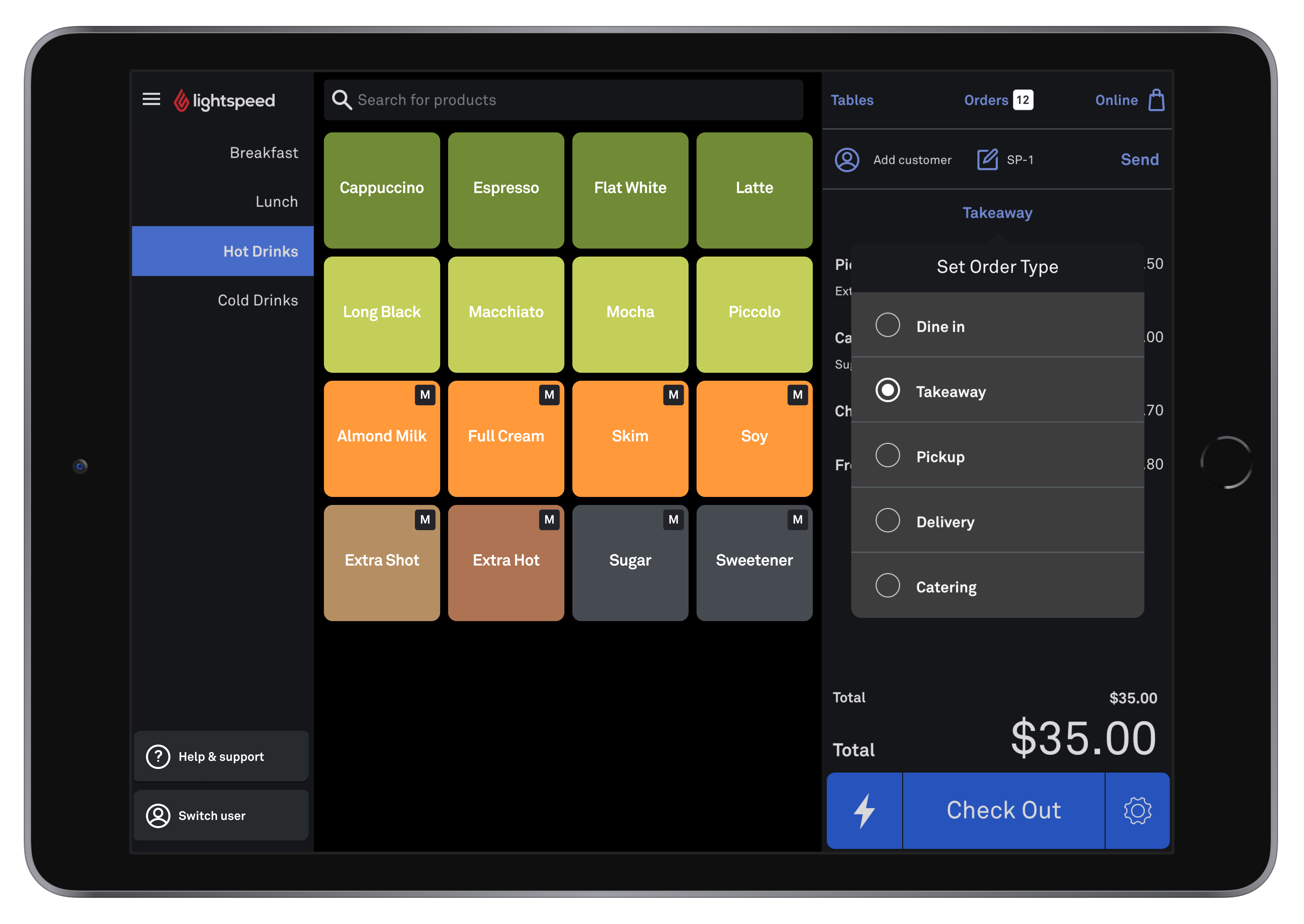

Determining the appropriate Point of Sale system demands an understanding of its features and functionality, as well as how it can fit with your business goals. Aspects to consider include simplicity, ability to integrate with other software, support for different payment methods, and security features to safeguard customer data. A suitably picked POS system can change business operations, boost customer experiences, and eventually drive growth.

Selecting the Right POS System

Determining the right POS solution is vital for the effectiveness of your business. Commence by recognizing your distinct operational needs, as different industries require diverse functionalities. For example, a retail business might prioritize inventory management and customer reward features, while a restaurant may need effective table management and gratuity handling. Grasping the exact demands of your business will help narrow down the alternatives and highlight the systems that provide the best features.

Next, think about the scalability of the POS solution. Your enterprise might be modest today, but progress is often the aim. Choose a solution that can grow with you, supplying additional features and integrations as your demands change. Look for cloud-based solutions that allow for easy updates and scalability without the burden of extensive hardware changes. best point of sale for restaurants will ensure that your funding remains viable in the long term, responding to the requirements of your growing operations.

Finally, assess the payment processing methods that the POS solution provides. It is essential to pick a processor that offers diverse payment types, including credit and debit cards, mobile payments, and tap to pay transactions. Security features should not be overlooked, as PCI compliance is essential to safeguard customer data and build trust. Assess the costs associated with transaction fees and overall compatibility capabilities with your present systems. A seamlessly connected payment processor can enhance efficiency and create a seamless customer experience, making your POS solution a effective tool rather than just a basic device.

Ensuring Security and Compliance

In today's digital environment, ensuring the safety and conformity of your POS system is paramount. Businesses must prioritize safeguarding critical customer information, especially transaction data, to mitigate cyber threats. Using strong encryption methods and ensuring secure connections can significantly reduce vulnerabilities. Periodically updating your system with the latest security patches is important for keeping your POS system resilient against emerging threats.

Conformity with regulations such as PCI DSS is vital for any business that processes payment transactions. Comprehending these guidelines not only helps protect customer data but also shields your business from potential legal ramifications and hefty fines. Staying informed about compliance requirements and conducting routine audits will guarantee that your POS system meets industry standards.

Moreover, investing in a secure POS system can improve customer trust and loyalty. By being transparent about your security measures and demonstrating a commitment to protecting their data, you can create a positive reputation. Additionally, training staff on security best practices will encourage a culture of vigilance, ensuring all employees plays a part in upholding security and compliance in your organization.